A Legal Engineer’s Guide to a “Fair Launch” ⚖️ 🚀

$YAM Case Study #3 — Lessons in Degenerative Agriculture

Food Token Printer goes Brrrrrrrrr

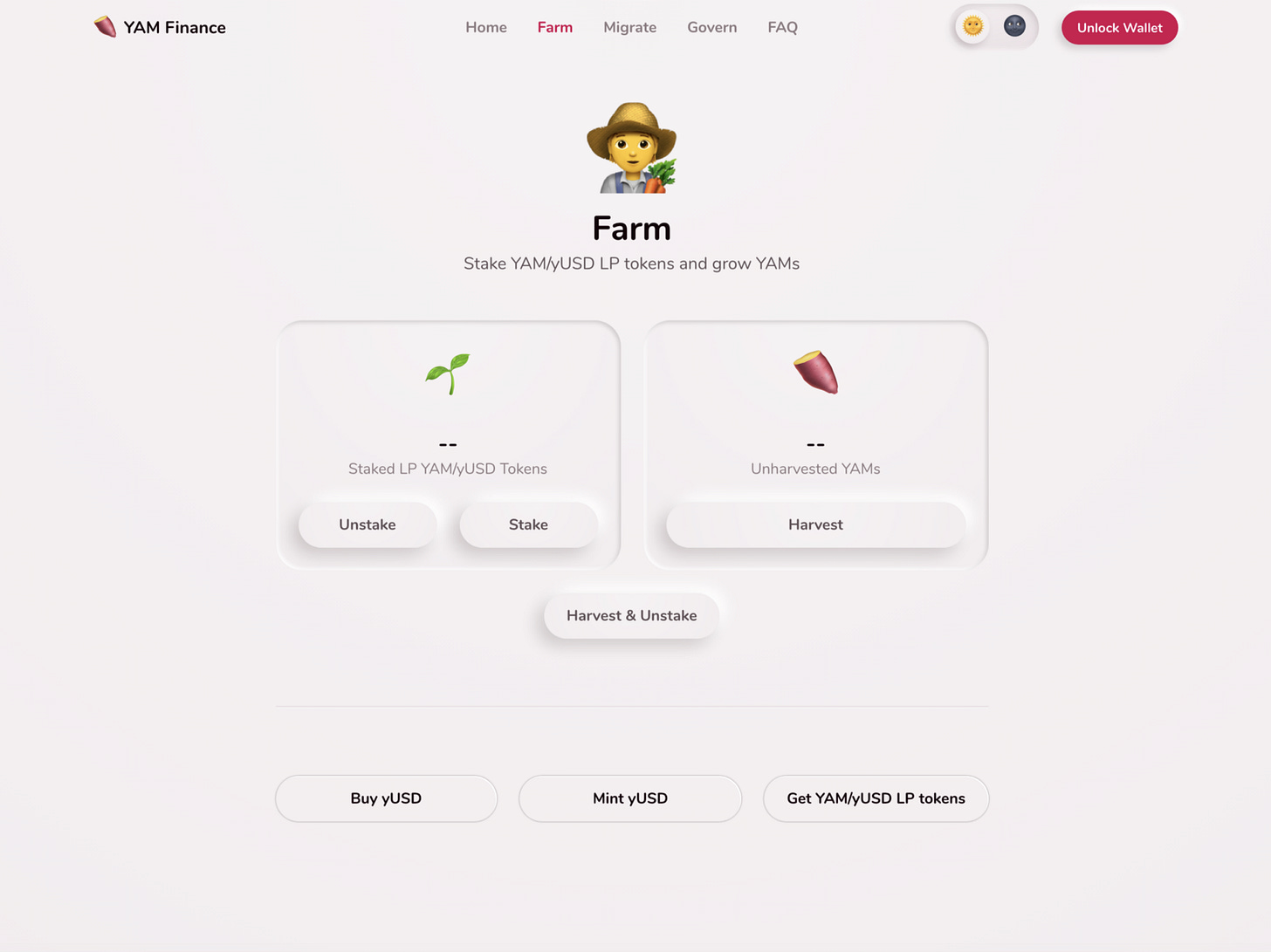

Much like the plot to Ready Player One, $YAMs starts with a game, metaverse incentives and a love interest. Much like the gunters are in pursuit of financial incentives or “eggs”, the players of $YAMs are looking for tokenized $YAMs, conjured from the ERC20 factory. Within the game, are layered financial incentives to encourage certain gamified behaviours. With an interface reminiscent of Farmville, players stake various tokens that are locked in a smart contract forked from Synthetix, and earn a share of a pool of tokens called $YAM that are released on a per block increment with the staked players. Players and farmers love yield.

This is actually the YAMSv3 user interface

Advancing on the YFI concept, the developers used the farming meme to stake certain tokens to acquire $YAM governance tokens that were declared without value as they are released through yield farming. The project made clear that the token would have zero value and the project developers let it be known that they would not be guaranteed tobe part of the protocol after launch. These tokens were conjured from thin air and really only have a programmatic scarcity. The scarcity of which is enforced through the governance process (which can and actually were changed). The developers tried to make clear that ubiquitous status by stating “We have no collective entity or interest other than an excitement to see how this experiment plays out. At this time, we have no intent to play a further role in the Yam protocol, aside from some of us expecting to harvest YAM on a modest scale on equal footing with all other farmers.”

Push for Ludicrous YAM mode

Is this a successful Howey defense? Time will tell, but it does clearly put everyone on notice that the development team is not offering to provide any work in the future. They may or may not, and it would be determined based on the governance of the protocol through the decentralized token $YAM launch. Basically $YAM is whatever the community makes it into. A game with somewhat of a blank slate. Interestingly, Coinbase through listing YFI, means that “fair launch” decentralization might be a path to having tokens NOT given the security treatment through cooperative ownership of the protocol. As far as Coinbase signalling goes, they probably think that the risk of it being deemed a security is a manageable risk. But who knows what the regulatory bodies will think of vegetable token farming. Many agricultural products are regulated as commodities. What are rebasing virtual $YAMS in the taxonomy of assets? What is obvious is that the tokens do accrue a value as the network, meme value, and interest grows.

But why are $YAMs a “fair” launch? How is the community selected?

Here the governance tokens are “earned” through staking of other tokens of various market value. In some way, it is self selecting to attract those that are most interested in the degenerative finance meme. For example, by choosing $COMP token, the community is rewarding and selecting for those that are already part of tokenized governance of other protocols such as Compound. It is a very crafty way of a community vampire attack versus a protocol vampire attack. The community vampire attack is to syphon attention from those that are part of another community.

The success of bootstrapping community from these attacks remains to be seen. Whether they are just zero sum or value accretive remains to be seen. Different yield farms will fall into the four categories, of win/win, lose/lose, win/lose, and lose/win for the impacted protocols. $YAMs obviously had an impact on governance tokens that were required to farm the token. The amount of governance tokens staked in the system were large enough to pose a systematic risk to the $COMP and $MKR token systems. A loss through theft or malfeasance of the amount of governance tokens staked in the fun farm app, were enough to trigger emergency shutdown of the MKR system if the “thief” desired.

Rebasing in brief

One innovative difference from previous projects is that $YAM was also a fork of Ampleforth AMPL tokenomics where the token expands in quantity when it is above a certain peg. $AMPL is a controversial token model that is backed by no assets and is intended to reach a stable value based on algorithmic “rebases” when the token is above or below a peg. The concept is outside of the scope of this article, but basically if the token value is over a dollar, then more tokens are minted directly to the wallets of the token holder. Analogous to a stock split. So can Dumbo fly because of the feather or the big ears? time will tell whether meme value can accrue to these algorithmic token models.

The novel concept is that with each $YAM rebase a portion of the inflation is earmarked toward the protocol treasury — a “development fund”. When the $YAM token rebases a certain portion of the inflation goes to fund future development of the protocol or a Yam protocol Treasury governed by the token holders. Theoretically this would be a self sustaining model of protocol management. If the value of the project exceeds $1 per token, then it will rebase with a portion of the rebase going to the treasury. If the project fails, then the token will spiral in some sort of mathematical loop toward zero, with each rebase resulting in less tokens and no value accrual to the $YAM treasury.

For the uninitiated, many projects have suffered without any ability to raise funds to provide for the future development of the protocol. This is an issue with all open source development, Linux included. So the algorithmic funding model for future development is an advance as it sets in stone what the code law is meant to be.

Well what happened next?

$yUSD tokens are locked in contract in an endless liquidity loop

Arguable $YAM decentralized too fast. It was discovered that the “unaudited code” for the rebasing mechanism had a bug. And they were unable to fix the bug in the smart contract that basically locked the governance of $YAM where a quorum could not be reached and the rebasing bug could not be patched. Trade off between authoritarian points of failure and not being able to have decisions made through lack of consensus.

Yep, diamonds are forever and so is the locked yUSD liquidity

So it failed?

As a social coordination experiment it can be seen either as a success of failure. First, the community quickly mobilized to exit the liquidity pools in an coordination challenge to save the network at the expense of their own rewards. Then $YAM holders agreed to migrate their $YAMS (rebasing) to $YAMS2 (standard ERC20), then audit the code and proposed to relaunch with $YAMS3 (a rebasing token). So despite the code failure, the “community build”, the social purpose, and the interest in “food” coins was market validated. $YAMv3 has since been replanted, relaunched and are rebasing away.

From meme to 2.89M in Treasury

The rebases have resulted in $2.89 million in yUSD treasury as of date of snapshot. The treasury is tokenized yielding assets see part #2 for $YFI post for explanation of yield bouncers. That means that the treasury is accruing value as it is in the $YAM bin.

We have a fair launch project that launched $YAM

The $YAM token rebases when it is above or below the parameters

Upon each positive rebase a portion of the “inflation” $YAMs are sold to purchase a meta $yUSD dollar.

This $yUSD meta token is a reconstituted FrankenFood of stablecoins. The metadollar is continuously compounding value for its treasury.

The $YAMs community has also agreed to earmark a portion of “Developer Fund” to community (same with YFI) to Ethereum Gitcoin grants to fund the commons.

What is next for the upcoming $YAM season of degenerative agriculture?

That is a good question. Much like this robot from Rick and Morty. $YAM is seeking its purpose and perhaps filled with existential dread. This almost makes it a $YAM based SPAC. Wouldn’t it be funny if they voted to use treasury to market buy a governance stake in another tokenized vegetable. Remember current food token guidelines are to limit exposure to vegetable tokens to 4–5 servings per farm season.

Special thanks to Adam J Kerpelman for providing comments. Next case study to follow will be Sushi, stay tuned…..

All links provided are for informational purposes only and not meant as recommendations of the people or products. Nothing herein is legal or financial advice and should not be relied upon without reaching out to your own personal attorney. The linked ABA disclaimer is appended to the blog.

LexDAO is a non-profit association of legal engineering professionals that brings the traditional legal settlement layer to code, and coded agreements to the masses. We believe that everyone deserves access to justice provided in a quick and efficient manner. If legal services were easier to use, verify, and enforce, we could live in a fairer world. Blockchain technology offers solutions to many problems in the legal space. Our mission is to research, develop and evangelize first-class legal methods and blockchain protocols that secure rules and promises with code rather than trust. We do this by training LexDAO certified legal engineers and building LexDAO certified blockchain applications. We strive to balance new deterministic tools with the equitable considerations of law to better serve our clients, allies, and ultimately citizens.

lexDAO.chat to discuss more

To be continued…..