Edition No. 2 - LexNews+ Weekly

The "Torres Doctrine"; BTC ETF applications; UK Crypto updates; New Legislation proposal from the House Committee on Agriculture; Coin Center suit against IRS dismissed as unripe. & racing hamsters?

Hi anon :)

Welcome back to LexNews+ Weekly! This letter is meant to provide LexDAO members and subscribers easy-to-digest summaries of the biggest stories in cryptolaw each week, as well as internal updates of LexDAO operations and projects. We’re excited to continue to expand the horizon of LexDAO’s impact through this medium, and to continue to build out the profession of legal engineering. Let’s get started!

Authors: Kyler Wandler, Nick Corso, Kris Jones, @TxBlokChainLaw

Sections:

1. Headlines (The top stories in cryptolaw this week)

2. Podcasts

3. LexDAO weekly loadout (agenda, events, publications, and more!)

4. Closing Statements

Headlines

Five things you might have missed this week:

The “Torres Doctrine” 👩⚖️

America needs more Torres.

On Tuesday, United States Representative Ritchie Torres (D) released a letter criticizing the Securities and Exchange Commission’s (SEC) continued efforts to classify the majority of crypto assets as securities. This comes after Judge Analisa Torres, presiding over the landmark Ripple Case (XRP v. SEC), issued a summary judgment ruling XRP in and of itself is not a security. Congressman Torres characterized this ruling as a “dreadful day in court” for regulation-by-enforcement and called for the establishment of the Torres Doctrine — bearing the name of Judge Torres — as a new legal standard for crypto regulation.

As Congressman Torres summarizes it, the Torres Doctrine,

“Holds that crypto assets are not securities in themselves but can be sold as part of investment contracts, which do qualify as securities under the Howey Test.”

In his letter, Torres also expresses optimism for other SEC targets, such as Coinbase, in future legal actions, asserting Judge Torres’ ruling correctly undermines the SEC’s “tenuous legal foundation” seeking to classify cryptocurrencies such as Cardano (ADA), Solana (SOL), and Polygon (MATIC) as securities.

While the recent ruling represents a huge win for the industry, it is important to note other courts are not mandated to follow Judge Torres legal analysis of the Howey Test. Moreover, the SEC still has the right to appeal her ruling to the Second Circuit Court of Appeals, a move many expect will be made soon.

Nonetheless, many courts across the country look to the federal district court on which Judge Torres sits in the Southern District of New York for persuasive guidance on all manner of financial legal issues, including those surround digital assets. As such, stakeholders across the broader crypto industry have joined Congressman Torres in celebrating the summary judgment as a step forward in building a productive legal framework for cryptocurrencies in the U.S.

BTC ETF Applications Piling Up on SEC Doorstep⚖️

You’ve got mail!

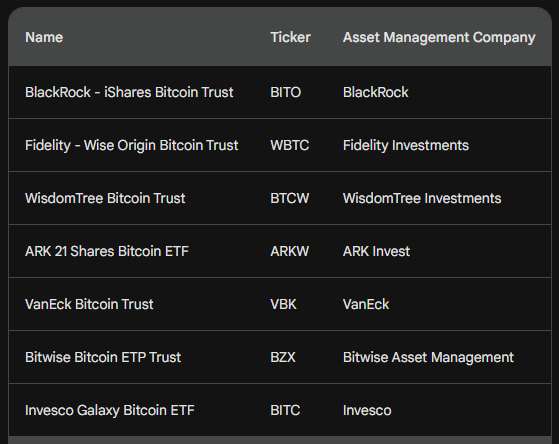

The number of applications for proposed rule changes hitting the Federal Register has increased to seven, with an eighth application expected to join them on Friday. The list looming over the SEC now consists of:

Valkyrie’s application for their Bitcoin Fund ETF has not yet been published but was accepted on Monday by the SEC and is expected to join those published on Friday.

Obviously the decision is not made, but many have speculated that the applications by major traditional finance firms like BlackRock and Fidelity bolster the chances of BTC ETF approvals by the SEC. The growing number of applicants clamoring for similar approvals seems to be echoing the sentiment, Gary’s environment of regulation-by-enforcement be damned.

BlackRock submitted its original application in June, but was notified of deficiencies and took time to amend its application. The updates mostly related to a Surveillance-Sharing Agreement (SSA) with Coinbase, attempting to address the SEC’s concern of market manipulation that has been referenced in previous BTC ETF denials. The SSA agreement with Coinbase appears

All but one (the Bitwise ETP) of the applications published in the Register refer to “The Spot BTC SSA” as a service provided by Coinbase as a means to address issues of Market Manipulation. As part of the SSA, Coinbase must share information about market trading activity, clearing activity, and customer identity. Coinbase is the top cryptocurrency exchange servicing BTC/USD spot trade volume in the U.S. which was the reason for its selection to provide this service for the ETF filings. While logical for the ETF filings, Coinbase hasn’t been in the SEC’s good books of late.

It is unclear how an SEC acceptance of Coinbase as a method of dealing with market manipulation might color the agency’s view of its claims against Coinbase of operating an unregistered securities exchange, but the US government has never let an SEC suit against Coinbase stop it from using the company to prop up their processes (to sell seized BTC).

The publication of the applications in the Federal Register now opens a 21-day public consultation and comment period. The SEC has an initial window of 45 days to issue an approval or denial of the applications, but may extend the review process and deadline for as long as 240 days. Ultimately a decision must be published sometime between early August of this year and spring (Q1?) of 2024.

Will we have an early thaw with TradFi Bitcoin ETF approvals leading the way, or will Gary see his shadow and give us 30 more weeks of Crypto Winter? we are so back, WGMI, and so on…

(see also: kitco, coindesk, cointelegraph, reuters, cryptorank, forbesindia, federal register (USA))

UK government rejects lawmaker’s call to treat crypto like gambling 🎰

Get that sh*t out of here…

The United Kingdom’s Economic Secretary to the Treasury Andrew Griffith has roundly rejected a proposal by the House of Commons Treasury Committee to regulate retail cryptocurrency trading in the same manner as gambling. A panel of UK lawmakers put forth this proposal by concluding gambling and crypto investments entail the same risk and regulatory outcome.

In a firm rejection, Secretary Griffith disagreed with the committee’s position that unbacked crypto assets are better regulated as gambling activity, rather than as a financial service. The UK government’s response also highlighted the potential conflict such a proposal would have with globally accepted recommendations from international organizations and other major jurisdictions including the EU, in addition to the regulatory uncertainty it could create with regard to overlapping mandates between financial regulators and the UK’s Gambling Commission.

Moreover, the government has already issued potential cryptocurrency legislation which could take effect by late 2023. The proposed legislation looks to provide uniform standards by which compliant cryptocurrency firms can operate within the UK.

House Committee on Agriculture (???) announces Financial Innovation and Technology for the 21st Century Act 💸🌳

Who says money doesn’t grown on trees?

Representatives Glenn "GT" Thompson, French Hill, and Dusty Johnson, chairing various subcommittees within the House Committee on Agriculture, have introduced H.R. 4763, the Financial Innovation and Technology for the 21st Century Act, a landmark piece of legislation aimed at building a comprehensive regulatory framework for the digital asset space. Other contributors to the Act include Representatives Tom Emmer and Warren Davidson.

Tl;Dr:

U.S. Representatives Glenn Thompson, French Hill, and Dusty Johnson have introduced a legislative bill, the Financial Innovation and Technology for the 21st Century Act, H.R. 4763.

This Act aims to establish a comprehensive regulatory framework for the digital asset space, promoting innovation and providing robust consumer protections.

The Act addresses existing authority gaps and was created in collaboration with stakeholders and market participants to enhance U.S. leadership in financial and technological innovation.

The legislation seeks to bring clarity to the currently uncertain regulatory environment surrounding digital assets by laying out clear operational principles and giving both the CFTC and SEC regulatory authority.

The Act, which was also worked on by Representatives Tom Emmer and Warren Davidson, is seen as crucial for maintaining the U.S.'s position as a global leader in technology adoption and innovation.

The House Financial Services Committee is aiming to pass the bill in the upcoming week.

This Act represents a significant stride by the House Committees on Agriculture and Financial Services to cultivate a regulatory environment that promotes innovation and leadership in the digital asset domain while safeguarding consumers and investors. The Act’s drafting involved extensive consultation with stakeholders and market participants, ensuring that it addresses existing authority gaps and empowers the U.S. to lead in financial and technological innovation.

The Act would have prevented incidents like the FTX case, where billions of customer funds were misappropriated, by instituting robust consumer protections and clear rules for market participants. The legislation also acknowledges the urgent need for a functional regulatory framework, considering the current uncertainties and the lack of authority and core operational principles in the digital asset sphere.

Rep. Dusty Johnson emphasized that the Act gives both the CFTC and SEC a seat at the regulatory table, aiming to instill financial security and certainty as digital asset developers continue to innovate.

The Act is seen as critical for the U.S. to maintain its position as a global leader in technology adoption and innovation, especially in the wake of other countries advancing their digital asset regulatory frameworks. By providing clear rules for the digital asset ecosystem, the FIT for the 21st Century Act can foster the full potential of these technologies in the U.S. The House Financial Services and Agriculture Committees coordinated closely on this legislation, aiming to pass the bill in the Financial Services Committee in the coming week.

Suit Challenging Crypto Information Reporting Is Dismissed 🕵️♂️

Coder, trader, spy.

Coin Center, the non-profit advocacy group, took a stand against the US Department of Treasury and the Internal Revenue Service (IRS) over a controversial crypto tax reporting amendment in the Infrastructure Investment and Jobs Act (6050I). Taking effect in 2024, this amendment mandates that US taxpayers receiving over $10,000 worth of crypto assets record and disclose personal information of the sender, including their Social Security number. Coin Center filed a lawsuit arguing that this provision is unconstitutional, infringes upon the First Amendment right to freedom of association, and would place a chilling effect on the vibrant crypto ecosystem.

However, the tides turned unfavorably for Coin Center when the district court dismissed its lawsuit as unripe, thereby delaying any immediate addressal of this significant regulatory concern. Jerry Brito, Executive Director of Coin Center, expressed his disappointment at the decision, pointing out the intrusion into personal identifiable information (PII) without a warrant that this amendment entails. As the law comes into effect in 2024, the clock is ticking for the crypto community. Coin Center, undeterred by this setback, plans to appeal to the Sixth Circuit.

The ultimate outcome of this legal challenge holds significant ramifications for the future of crypto regulation in the United States. Should the amendment be ultimately deemed unconstitutional, it could not only mark a major triumph for the crypto industry, but also set a precedent for future challenges to crypto regulations. Given its impact, we at LexDAO will continue to closely monitor this case, as the unfolding legal discourse may signal important changes in cryptolaw.

"This law take effect on Jan 1, 2024, and will require citizens who are recipients of crypto payments of $10,000 or more to report to the government not just the transaction, but the PII (personal identifiable information) of the sender as well–all without a warrant.”

Podcasts

Too tired to read, anon? We feel that. Try these instead:

LexDAO weekly loadout:

Updates and agendas for all things LexDAO can be found here at the Governance Agenda Document

WEEKLY AGENDA:

Closing Statements

We want to hear from you:

If you enjoyed what you read today, subscribe to receive the weekly publication and give the authors a follow on Twitter for live updates throughout the week. Additionally, consider becoming a member of LexDAO!

Did you make any money racing hamsters this week? That was pretty wild. Charlie (the hamster) was a disappointment, to be frank, but overall quite pleased. :)

LexDAO, scaling legal engineering together.

Quote of the Week:

“Maybe you only hate the hamsters because you’re stuck in the rat race.”

- reza.eth