Edition No. 4 - LexNews+ Weekly

Federal Judge upholds OFAC sanctions against Tornado; SBF misbehaves and has bail revoked; the industry rallies around Coinbase with amicus briefs; SEC delays ARK BTC ETF; Bittrex settles with SEC

Hi anon :)

Welcome back to LexNews+ Weekly! This letter is meant to provide LexDAO members and subscribers easy-to-digest summaries of the biggest stories in cryptolaw each week, as well as internal updates of LexDAO operations and projects. We’re excited to continue to expand the horizon of LexDAO’s impact through this medium, and to continue to build out the profession of legal engineering. Let’s get started!

Authors: Kyler Wandler, Nick Corso, Kris Jones, @TxBlokChainLaw

Sections:

1. Headlines (The top stories in cryptolaw this week)

2. Podcasts

3. LexDAO weekly loadout (agenda, events, publications, and more!)

4. Closing Statements

Headlines

Five things you might have missed this week:

US Federal Judge Upholds Sanctions against Blockchain Privacy Software Tornado Cash 🌪️

Call the red cross.

In a significant development, US District Judge Robert Pitman dismissed the arguments of six plaintiffs who contended that the US government overstepped its jurisdiction by sanctioning blockchain privacy software Tornado Cash. The plaintiffs had challenged the US Treasury's Office of Foreign Assets Control (OFAC) decision last August, which held Tornado Cash responsible for facilitating the laundering of $7 billion in cryptoassets from 2019.

The plaintiffs' primary assertion was that Tornado Cash, being software, should not be treated as a foreign “national,” “person,” or group. Leading crypto-exchange, Coinbase, supported this lawsuit, aiming to check the Treasury's overreach and to remove Tornado Cash from OFAC’s list of sanctioned entities.

However, Judge Pitman's decision took a different stance, indicating that under the International Emergency Economic Powers Act, Tornado Cash can be categorized as a “person”, given it comprises its founders, developers, and its Decentralized Autonomous Organization (DAO). The judge emphasized that these groups collaboratively worked to promote and monetize Tornado Cash:

“The record sufficiently supports OFAC’s determination that the founders, the developers, and the Tornado Cash DAO have acted jointly to promote and govern Tornado Cash and to profit from these activities.”

The debate also extended to the definition of smart contracts. Plaintiffs claimed smart contracts can't be treated as property since they are not ownable. The judge responded by comparing smart contracts to vending machines that serve a specific function without human interference. He emphasized that this self-execution does not detract from their status as a type of contract and therefore can be regarded as property.

While critics suggest that such sanctions could deter software development by infringing on developers' free speech rights, the court disagreed. The case will now advance to the Fifth Circuit Court of Appeals for further review.

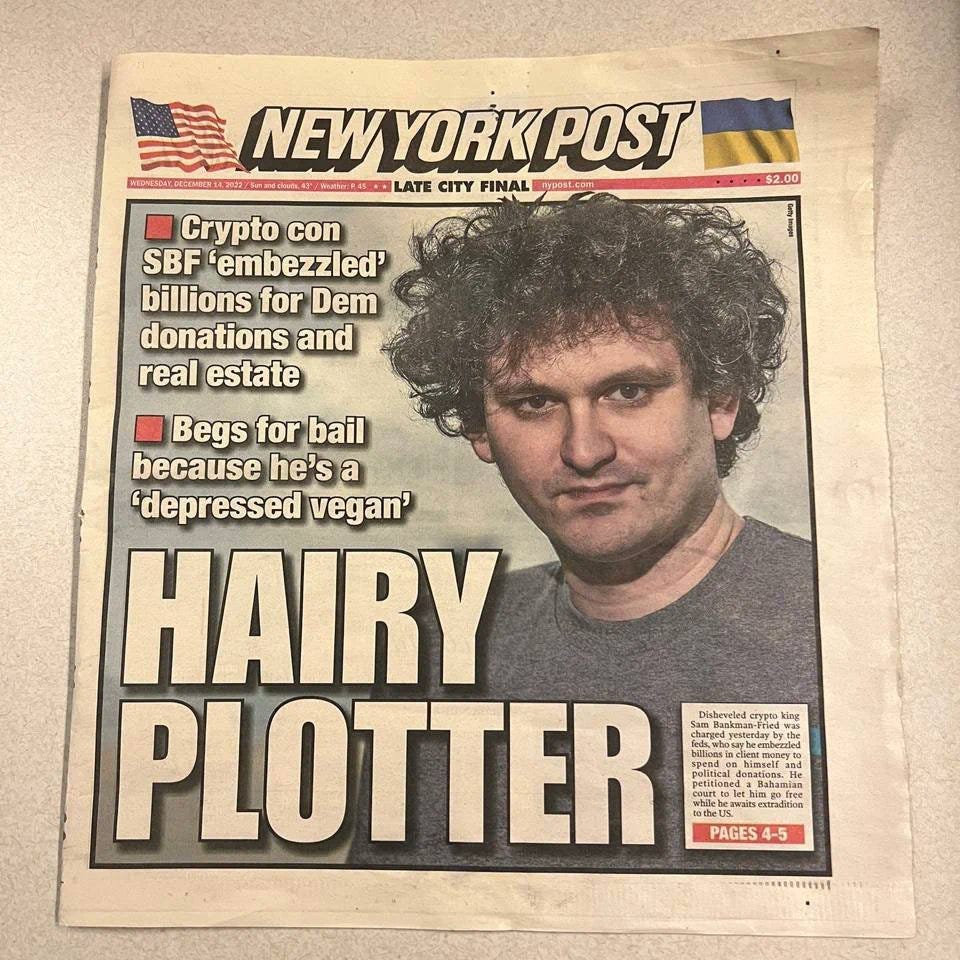

Sam Bankman-Fried has bail revoked after ‘poor behavior’⚖️

The consequences of poor parenting.

The tribulations of Sam Bankman-Fried (SBF), founder of FTX, continue after a federal judge in New York revoked his bail. This comes after SBF allegedly tried to influence witnesses slated to testify against him in his upcoming fraud trial stemming from the collapse of FTX.

The revocation means SBF will no longer reside at his parents’ house in Palo Alto, CA, where he’s lived since his arrest in December. The Judge’s decision came after the prosecution argued SBF, on two separate occasions, tried to tamper with witnesses by providing documents to reporters. The government’s motion alleges SBF sent over 100 emails and made over 1,000 phone calls to members of the press, and even went so far as to leak diary entries of former friend and FTX colleague, Caroline Ellison.

“My conclusion is there is probable cause to believe the defendant tried to tamper with witnesses at least twice,” - Judge Kaplan

Judge Kaplan previously relayed a warning to SBF for his interaction with the media in July. However, counsel for the New York Times and the Reporters Committee for Freedom of the Press filed a letter objecting to SBF remaining in custody because of free speech concerns. SBF’s attorney’s raised similar arguments, but clearly to no avail. The government has requested SBF remain in custody in Putman, NY, allowing him to have internet access for trial preparation, rather than in the Metropolitan Detention Center where internet access is limited.

Industry rallies around Coinbase, filing amicus briefs in support 🫶

It pays to have good friends.

Several amicus briefs were filed this week in support of Coinbase in its ongoing dispute with the SEC. Six securities laws scholars—professors from Yale, University of Chicago, UCLA, Fordham, Boston University, and Widener—filed an amicus brief examining the relevant case law for the term “investment contract.” The six scholars concluded every investment contract identified by the United State Supreme Court contained a contractual undertaking to grant a stake in an enterprise. This conclusion directly contradicts the SEC’s argument that digital assets sold on secondary markets are in fact investment contracts subject to the agency’s jurisdiction.

In addition, two influential organizations in the digital asset space, Paradigm and a16crypto, also filed a joint amicus brief reaching essentially the same conclusion—that an investment contract requires a contractual obligation.

These legal scholars and industry organizations are not the only ones rallying in support of Coinbase. Senator Lummis, a reliable supporter of the digital asset space, filed an amicus brief supporting Coinbase’s motion to dismiss arguing that the SEC is attempting to circumvent the legislative process. Indeed, many industry stakeholders agree the SEC has been attempting to claim authority over all digital assets, even while Congress considers legislation delegating this authority to other agencies.

“Although the SEC seeks broad authority over crypto asset markets, most legislative proposals in Congress would instead grant much of that authority to other agencies. Unsatisfied, the SEC seeks to circumvent the political process to commandeer that authority for itself” – Senator Lummis

SEC Delays ARK Bitcoin ETF - Opens Comment Period

SEC plays stick in the mud once again.

The SEC has delayed its decision on the ARK21Shares Bitcoin ETF application. The original deadline was August 13, but the SEC has instead opted for a 21-day comment period. Specifically, the SEC is looking for feedback from interested parties on the potential for manipulation of the Bitcoin markets, the susceptibility of Bitcoin ETFs to such manipulation, and potential ways to avoid issues related to BTC market manipulation through liquidity provisions, transparent operations, or other means.

The most significant addition to the amended applications for Bitcoin ETFs included surveillance sharing agreements with Coinbase in an effort to guard against BTC market manipulation. This appears to have been in response to concerns raised by the SEC in previous application denials around possible “manipulative acts and practices.”

The ARK proposal was submitted in May, which gives the SEC a maximum of 240 days, or up to January of 2024, to make a decision. Cathie Wood, founder and CEO of ARK anticipated the delay, discussing the matter in an August 7 interview with Bloomberg. In the same interview she also predicted the commission could approve multiple spot BTC ETFs at once.

The SEC has already approved several Bitcoin futures ETFs but has yet to approve a spot ETF for the digital asset despite recent applications from many major investment firms including Blackrock and WisdomTree.

With such interest from major players to offer an approved Bitcoin ETF, Wood’s prediction of simultaneous approvals may come to bear, though simultaneous denials are also a distinct possibility. For the time being the decision seems to hinge on the question of market manipulation and the ability of the industry to demonstrate transparency at levels that satisfy the SEC. For now, all stakeholders can do is comment.

(see also: coin telegraph, cnbc, investopedia, sec.gov)

Bittrex Settles SEC Claim

Pay the piper.

On August 10, Bittrex agreed to pay $24M to settle the case brought against the exchange and its former CEO William Shihara in April. The charges against Shihara related to coordinated efforts to scrub language involving investment contracts and other “problematic statements” from company documents in an attempt to evade securities laws. The charges against the exchange were broadly related to its operations as an unregistered broker, securities exchange, and intermediary.

As part of the settlement, Shihara, Bittrex, and Bittrex Global agreed to an order barring them from violating U.S. securities laws, but in doing so did not admit to any allegations. The $24M total is made up of $14.4M in disgorgement charges, $4M in prejudgment interest, and a $5.6M civil penalty.

In a quote for Forbes, Shihara said “This is a good outcome. It’s vital that our country strikes a balance between fostering innovation, encouraging entrepreneurs and the need to protect consumers, and I hope today’s proposed settlement helps move that forward."

Bittrex announced it would cease U.S. operations in March shortly before the SEC allegations became public and would eventually go on to file bankruptcy in May after the allegations became known. Bittrex Global is still in operation, but bars access to its platform from U.S. and Canadian IP addresses (it closed Canadian operations back in July 2022). Bittrex was also hit in 2022 with fines of $24M and $29M by the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) and Financial Crimes Enforcement Network (FinCEN) for violating U.S. sanctions programs.

References: (see also: reuters, forbes, cryptoslate, decrypt)

Podcasts

Too tired to read, anon? We feel that. Try these instead:

LexDAO weekly loadout:

Updates and agendas for all things LexDAO can be found here at the Governance Agenda Document

Gitcoin GG18 is now live!! Show your support for open-source legal engineering infrastructure by donating today — and don’t forget, every dollar donated is matched!

AGENDA / UPCOMING EVENTS:

Closing Statements

We want to hear from you:

If you enjoyed what you read today, subscribe to receive the weekly publication and give the authors a follow on Twitter for live updates throughout the week. Additionally, consider becoming a member of LexDAO!

Did you make any money racing hamsters this week? That was pretty wild. Charlie (the hamster) was a disappointment, to be frank, but overall quite pleased. :)

LexDAO, scaling legal engineering together.

Quote of the Week:

“If we're all supposed to know what the law is, then the law should be free and accessible.” - Jordan Teague