LexDAO May 2023 Recap

It has been an action-packed month for LexDAO with multiple events and discussions. Join us below for the latest happenings in the DAO and web3.

What's New in LexDAO

LexDAO continued its mission to support and drive growth in the intersection between the law and web3 technology this month with several exciting developments ranging from policy initiatives to the development of new tools and the expansion of our membership system.

Defense of Illinois Personal Property Against HB3479 [advocacy]

Last month, we highlighted a petition to halt the passage of Illinois Bill HB3479 that was set to significantly impact personal property ownership as it pertained to digital assets in that state. This month, the Illinois legislature ended its current term without passing the bill. LexDAO's position as an inclusive and open to the public non-profit community within the web3 ecosystem well-known for providing non-biased public goods allowed us to work closely with large organizations in this space to advance beneficial advocacy interests. We are grateful for the community's engagement and support of this initiative. To read more, see the DeFi Education Fund's Twitter thread on the topic.

LexDAO Co-Hosts Próspera Legal Engineering Summit [event]

LexDAO, Próspera, and Infinita VC co-hosted the Legal Engineering Summit 2023 between May 9-12, 2023 on the island of Roatan, Honduras. LexDAO’s Kyle Smith (bestape#3069) was in attendance and the DAO’s members were able to advance LexDAO’s vision of Ricardian LLCs as functional frameworks for legal ownership.

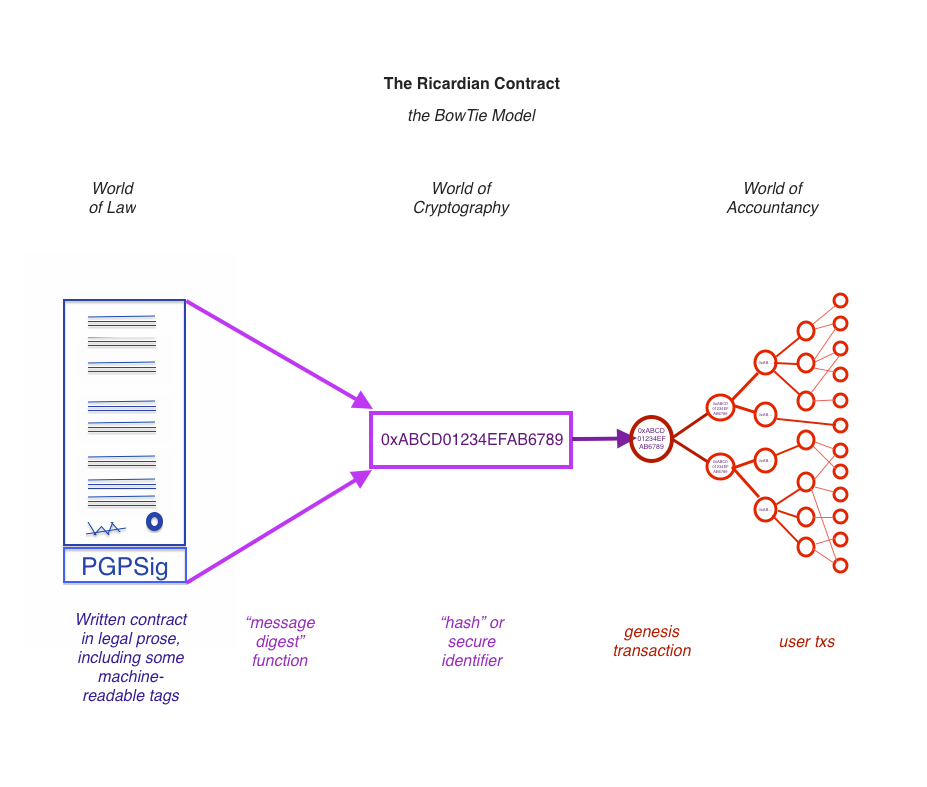

The mental model of Ricardian LLCs operates on the principle of inheritance, allowing one entity or source to inherit the properties of its parent progenitor. As a framework, the Ricardian LLC model allows contracts to automatically inherit legal status and rights through technical means, such as smart contracts, enabling efficient operation and transfer of rights.

An early LexDAO project, which started as a proof of concept for Ricardian LLCs, applied this framework to the creation of LLCs by utilizing a type of LLC known as the Series LLC to vest legal rights in a parent entity and allow for the generation of child entities which would inherit one or more legal rights and aspects from the parent. Rights could be held by a Series LLC formed within a particular jurisdiction, such as Delaware. Smart contracts would then allow child LLCs to be formed and automatically inherit certain legal and technical statuses from the parent in the Series through the minting of NFTs to wallet addresses associated with each child, documenting the creation of the children within the Series LLC on a blockchain. In this way, ownership of these legal rights could be simultaneously memorialized on a blockchain and represented by bearer bond style ownership of an NFT held by a separate legal entity. Although this method represents a novel transformation of the traditional systems for rights management, progress of Ricardian LLCs has been slow due to a lack of standardized recognition of Series LLCs in most U.S. States.

However, as part of the legal summit, Próspera expressed an intent to formally embrace these concepts to enable LexDAO’s vision for a Ricardian future to be realized. Próspera has approved LexDAO to draft a bill to enact legislation which would formally recognize the legal existence of Series LLCs. On top of this, Próspera and their land title registry will list these types of children in Series LLC and recognize their legal ownership of real property as vested in and demonstrated by NFTs.

One use contemplated at the Summit was the formation of a parent Series LLC with the Próspera government to hold title to real property, such as a 20-unit condominium complex. With one multi-function call to the Ricardian LLC's solidity contract held within an address associated with the parent LLC, 20 NFTs are created—each representing legal ownership of the each individual unit in the complex while serving the same function as a physical deed—and immediately place ownership within the newly formed children of that Series LLC. The rights in each NFT would immediately revert back to the parent on dissolution of the child LLC, avoiding issues with legal process present with traditional LLCs. And this process would have the added benefit of minimizing fees to be incurred by child LLCs. Próspera’s approval of legislation would recognize Series LLC’s ability to own real property and transfer title in that property and the legal rights associated with it through NFTs registered with their land registry.

Source: Wikipedia, Ricardian Contract.

Additionally, LexDAO’s presence at the Summit was instrumental in encouraging Bitso, one of the world's largest exchanges, to submit their first place project for judging and create pilot program to supplement SWIFT's wiring standard using XRP starting with good-standing and approved banks in three LATAM countries. The SWIFT standard serves a critical role in our current Global financial system and the supplemental program could significantly but invisibly increase adoption of cryptocurrency in traditional retail use cases in a safe, cost-effective and reliable way.

We are excited to see what the future collaborative efforts between Próspera and LexDAO will hold. Please join us on Discord to get involved in this process and see this article for more coverage of LexDAO’s participation and the winners of the hackathon that took place at this event.

Kyle Smith’s at ReFiSummit 2023 [event]

LexDAO’s Kyle Smith was joined by our good friends at supermodular, endaoment, and ImpactDAOs on a Governance Panel at the ReFiSummit that took place in Seattle, Washington from May 24-45. The panel discussed the field of Regenerative Finance or ReFi—an exciting and fast-growing area of web3 that seeks to promote global conservation. While this purpose has been traditionally accomplished through the sale of carbon credits, ReFi now seeks to develop a new asset: Valuation of real property in rural communities by ascribing value to the natural processes occurring on the land.

In the same way that art is valued based on its cultural significance, value can be attributed to natural resources based on their ecological worth and impact. Valuation information for land could be collected, stored on a blockchain network, and leveraged through the use of NFTs. LexDAO and our friends at the RWA Consortium, a project focused on the transformation of ownership of real world assets with roots at LexDAO, were in attendance at ReFiSummit to discuss this process and how valuations can verified on-chain. Representatives from the NVIDIA edge computing community, including Seeed Studio, were also in attendance to discuss their use of low-cost, single-board computers to serve as oracles for the blockchain networks processing this information.

See this Twitter thread for more information on how the valuation process is taking place for a parcel of swampland.

Enterprise Membership at LexDAO [governance]

We initially mentioned a proposal for a new membership type at LexDAO for internet-native organizations back in our January newsletter. LexDAO is now expanding it's membership offerings to better accommodate the growing network of web3-enabled communities and serve relevant legal and technological news, education, and tools to it's members and these communities.

We are excited to announce that the new enterprise membership type is being actively discussed to invite a growing organization within the web3 community to join us in this mission. Enterprise membership will cost US$10,000, half of which will go towards funding LexDAO grants to build additional tools and educate the community. Enterprise Membership will provide organizations with a number of benefits. Admitted organizations will receive five individual memberships for the organization to distribute to its members. Enterprise members will also be offered a monthly “AMA” for their community to ask LexDAO questions and plan separate information sessions within LexDAO to spearhead initiatives to assist the enterprise member with various projects. Enterprise membership options are also being considered for law firms. So please contact us if your firm is interested in joining our pilot program for enterprise membership.

More details will become available as enterprise membership undergoes ratification within LexDAO, so join us on Discord to be a part of this exciting change and find out how to you can help.

Community Research Survey to Support The DAO Research Collective’s State of Delegation Report [survey]

LexDAO member and the DAO Research Collective contributor, Kyler56 (Kyler56#4735), is preparing a report on the state of delegation in DAOs. To assist in collecting data for this report, Kyler56 has created a community research survey to solicit feedback from DAO contributors on the current state of DAO delegation mechanisms.

If you have five minutes (which should be plenty of time to participate) and would like to support this research, please fill out the survey here.

SEC Settles Insider Trading Charges Against Former Coinbase Employee [news]

The U.S. Securities and Exchange Commission announced on May 30 that it was settling its insider trading charges against former Coinbase Employee Ishan Wahi and his brother, Nikhil Wahi. The SEC filed a complaint in the U.S. District Court for the Western District of Washington against the Wahi brothers on July 21, 2022, alleging that the brothers engaged in a scheme to trade on material nonpublic information involving several cryptocurrencies ahead of multiple announcements that the assets would be listed for trading on Coinbase’s platform. Ishan was involved in coordinating the platform’s public listing announcements as part of his role at the company.

The complaint alleged that Ishan repeatedly tipped the timing and content of Coinbase’s upcoming listing announcements to his brother and to his friend, Sameer Ramadi, between June 2021 and April 2022 and would purchase specific assets ahead of those announcements. As part of the settlement, the Wahi brothers agreed to be permanently enjoined from violating Section 10(b) of the Securities Exchange Act and Rule 10b-5, to pay disgorgement of ill-gotten gains, plus prejudgment interest, and not deny the SEC’s allegations. Both bothers also pled guilty and were sentenced for conspiracy to commit wire fraud in a parallel criminal action where they were previously ordered to disgorge their gains and pay interest.

But the settlement raises questions about the strength of the SEC’s allegations. While the Wahi brothers pled guilty in their criminal action, they strongly contested the SEC’s claims. Paradigm filed an amicus brief on the brothers’ behalf arguing that the cryptocurrencies could not be securities themselves even if sold as part of securities transactions. And because the judgment entered in the criminal case had already ordered disgorgement, there were effectively no additional penalties placed against the brothers as part of this settlement. This suggests that the SEC may have sought settlement to avoid unfavorable judicial precedent on this issue.

See the SEC’s press release here for more details on the settlement and this Twitter thread for discussion of the SEC’s motivations to settle the case.

Get Involved!

LexDAO is always looking for new members! If you are interested in the work we are doing:

Check out our Discord and ask some questions (feel free to DM our Assistant Operator @Cimply#3820 with any onboarding questions).

Join our bi-monthly governance calls on Wednesdays at 12pm EST in Discord!

When you are ready to join, fill out this form and check out this post for all the information that you need to apply.