STABLE Act - A Legal Engineer's Perspective

STABLE can do well to recognize smart contracts protect consumers too.

Legal engineering smart contracts is coding within practical legal context. The nature of “should” and totality o’ liabilities lie in the long arm o’ law.

Therefore, for legal engineers at least, it’s always good practice to consider new legislation that might affect how smart contracts get used and deployed.

Occasionally, members of the U.S. Congress weigh smart contracted economic activity against rules-on-books for consumer financial protections—in this case, the issuance of “stablecoins” on blockchain networks with value pegged to fiat (1:1) so users can shelter from crypto volatility and engage in normal business transactions. The nature of this peg and related `guarantees` feel like crux of the moment. (This author merely hopes to illustrate that vending machines and banks are different threat actors.)

A copy of a proposed bill, the "Stablecoin Tethering & Bank Licensing Enforcement (STABLE) Act" can be reviewed here. It basically musters new requirements for “stablecoin issuers” to obtain a banking license and meet various reporting and solvency measures.

In brief, stablecoins are defined here as “crypto [that is] … denominated … or pegged to [fiat] …” and regardless of issuance intent, creates reasonable belief in a “fixed” redemption value.

This would seem to hit stablecoins issued on someone’s promise of fiat AND stablecoins issued by users themselves from smart contracts (e.g., DAI). These should present different threats to consumers and market order. A “one size fits all” approach to stablecoins to prevent harms in one case should not smother financial innovations that aim to remedy our “trust issues” with money.

To this end: It feels important to dig more into this salient distinction between centralized (“trust us”) stablecoins and decentralized issuances (“verify code”) to help Congress study this topic and consider costs and benefits more evenly to the U.S. economy.

STABLECOINS - CENTRA. v. DECENT.

If you purchase USDC, why do you think it’s worth $1? Trust and promises.

You can’t burn USDC and redeem against a smart contract*. Similar to Tether (USDt) and Gemini (GUSD) offerings, you need to establish a web2 account and talk to a person. (This of course involves doxing.) That person then must talk to a bank to release collateral in the form of USD. This USD hopefully finds its way into your bank account. So much can go wrong in this process, that yeah, legal agreements do much of the heavy lifting here to maintain market confidence in a 1:1 peg (i.e., placing liabilities on Circle and their partners for not meeting their redemption promises).

Where STABLE and similar seek to bolster these agreements with standardized obligations (regulations) over USD deposits represented by USDC, it seems reasonable in market fairness terms, as other trust-based financial services shoulder such legal burdens.

Also, for consumers, perception of risk matters, and one might reasonably assume that anything bearing a relation to paper USD is “regulated” to protect their interests. A clear menu of choices in the market between familiar $ and ($) tokenized, with all the various regulation *enhancements or *bugs, feels like a good way to ease the public into smart contracts.

If you mint DAI by locking collateral into a smart contract, why do you think it’s worth $1? Math and dash of hope.

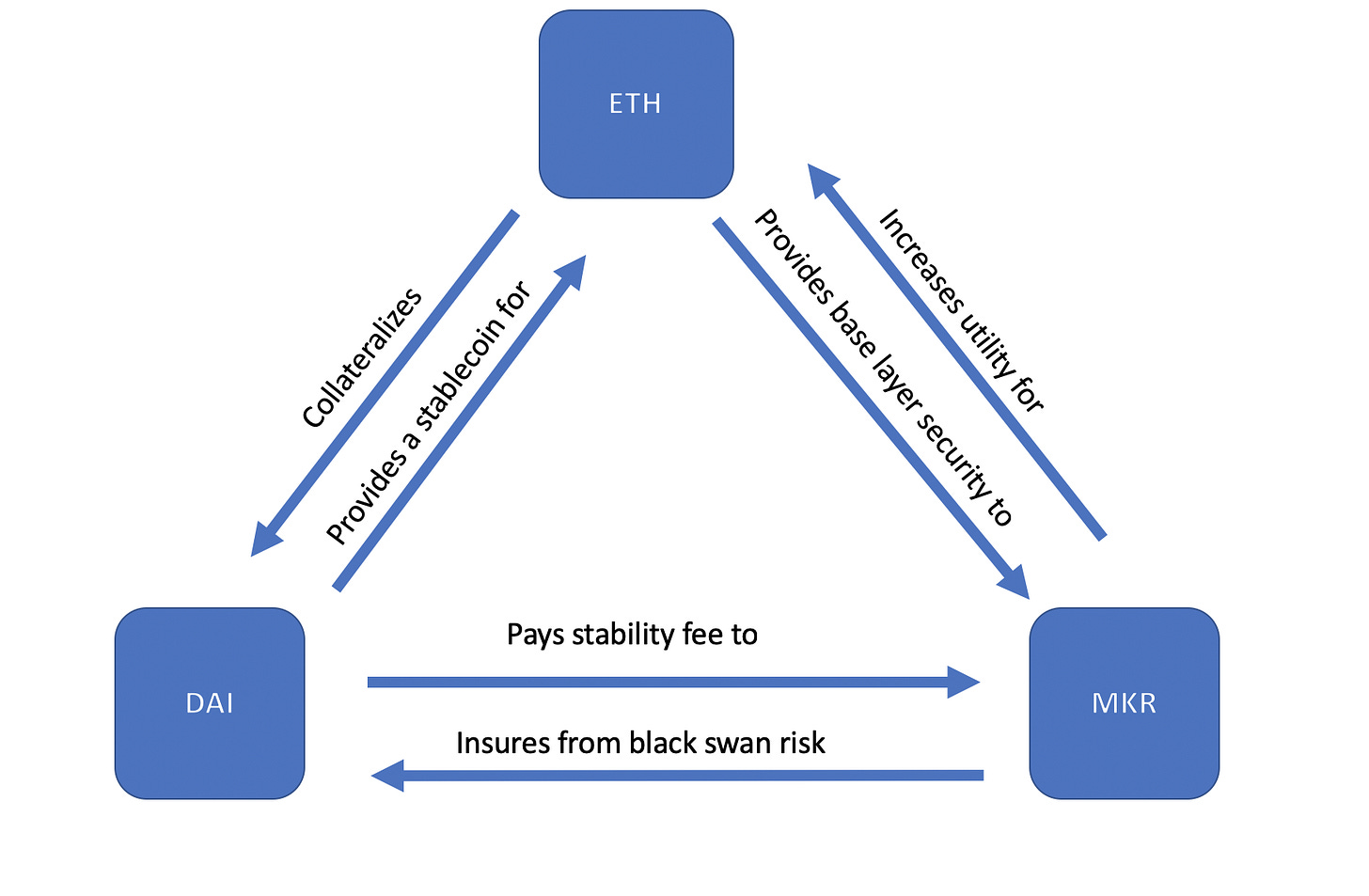

You can burn and redeem DAI for digital assets like ETH, a crypto-commodity, which has a volatile but established market for its value. Though there are certainly imperfections in this system, such as murky technical and governance risks, the DAI experiment has demonstrated that users can *themselves* create less-volatile digital assets in order to transact business on Ethereum without the need to trust a person’s promise over un-auditable fiat.

In terms of consumer protections: These smart contracts cannot discriminate and exclude access; anyone can verify how much collateral is locked at any given time in this system; and furthermore, users can be reasonably certain that after an Ethereum transaction confirms, they will receive funds.**

CONCLUDING 📕

The language of STABLE encompasses both centralized and decentralized stablecoin issuance. The risks posed to consumers in terms of redemption are very different, as one involves trust-based threats that normally invite regulation, and the other, technical risks that seem slight to the emergent consumer benefits of stable assets to transact peer-peer on blockchains like Ethereum.

To reiterate, STABLE is reasonable to the purposes of financial regulation where it protects the public from the inherent risks associated with centralized stablecoins. After all, these are admin-keyed instruments being tracked on blockchains and only have value based on the promise of redemption and “money in the bank” (which can’t be seen on block explorers like etherscan…). The powers of Congress do well to flex on bad actors backing tokens with fairy dust promises—if you say something is backed by fiat, it better be.

HOWEVER, stablecoins that aim for a fiat peg but are managed entirely with smart contracts present novel consumer protections, and extending STABLE’s definition of “stablecoin issuer” to this format feels misplaced in light of innovations on settlement without cost of third-parties. This time it’s different?

In terms of how STABLE can be better clarified to delineate these different kind of “issuers” as well as make its application fair (e.g., the 6 month notice for issuance feels like it may favor current players too much…), this will be the good work of the next few weeks. Many crypto attorneys are rapidly adding excellent comments:

Further, follow the LexDAO annotation of STABLE here if you have our community token, LEX ✍️.

*Ok, so you can swap USDC for DAI, tUSD, etc., peer-peer and on a decentralized exchange, like Uniswap. But, if the dollars backing USDC waver, good luck getting a good price.

**Blockchain networks like Ethereum still need to prove themselves over a longer period of time as a totally “consumer grade” platform for finance. (Decentralized stablecoins should probably see a discount from peg for this risk against premium for access and opportunities in DeFi?) Anyways, most consumers are not familiar with the risk of blockchain forks or the breaking impact upgrades might have on smart contracts. This risk is separate and apart, however, from the counterparty threat of someone holding money in a bank.